Hong Kong offshore company formation

International Finance Center

Simple tax system

We will only notify the newest and revelant news to you.

Whether you are doing business in Europe, Asia, Africa, the Middle East, the Americas or elsewhere, Offshore Company Corp will set up the best trading or holding structure for your business in line with local laws and regulations.

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

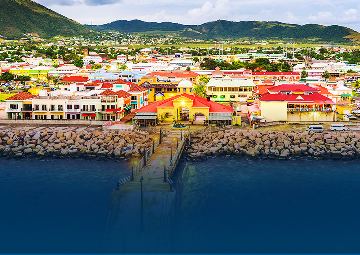

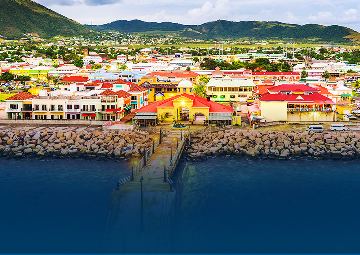

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

One of the world’s largest logistics hubs

Leading host for global foreign investment

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

Asset protection from a foreign corporation.

Better banking infrastructure.

See more jurisdiction we offer in the Asia Pacific and choose your favorite jurisdiction

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

See more jurisdiction we offer in the Europe and choose your favorite jurisdiction

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

See more jurisdiction we offer in the Caribbean and choose your favorite jurisdiction

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

See more jurisdiction we offer in the Middle East and choose your favorite jurisdiction

One of the world’s largest logistics hubs

Leading host for global foreign investment

See more jurisdiction we offer in the Africa and choose your favorite jurisdiction

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

See more jurisdiction we offer in the America and choose your favorite jurisdiction

Asset protection from a foreign corporation.

Better banking infrastructure.

From

US$ 571

A widespread misconception regarding business consulting services is that they are primarily used by large, well-established businesses. In actuality, business consulting is important regardless of the sizes of businesses. Expert guidance and knowledge on a range of subjects are offered by consultants, enabling businesses to operate more successfully.

Let's take a closer look at the significance of management consulting for small businesses by taking a look at the typical functions that management consultants play. We'll find that hiring corporate management consultancy has a number of advantages.

The ability of a business consultant to make reliable recommendations about how to move your company ahead is ultimately the most significant advantage of engaging one.

Business consulting effectively assists organizations in improving performance and efficiency. When choosing the direction their firms should go, the majority of business owners think about hiring business advisors. The majority of business owners employ consultants to spot growth issues, gain insight into a particular market, boost employee productivity, alter business paradigms, identify new business objectives, train staff, fire ineffective business strata, resurrect stale but promising business opportunities, and influence decision-makers. The first thing a consultant does when they join a firm or a client is find out what their goals are. After that, the consultant discovers the opportunities for growth and makes plans accordingly.

A BVI-registered agent is a licensed intermediary required by law for all British Virgin Islands (BVI) companies. They handle company filings, compliance, and official communications with the BVI Financial Services Commission (FSC). Occasionally, companies may need to change their registered agent, whether for better service, cost efficiency, or strategic reasons.

Here’s how to change your BVI registered agent:

Key Considerations:

For a seamless transition, professional services like Offshore Company Services assist with changing BVI registered agents, ensuring compliance, efficiency, and minimal disruption to your company’s operations.

In order to help any business with its administrative, human resource, and financial tasks, the government has granted a professional license to a corporate service provider (CSP), a business organization with professional qualifications. The corporate service provider helps you make sure that these businesses' operations adhere to the most recent laws and regulations set forth by the relevant government authority.

Fresh entrepreneurs oftentimes cannot tell the difference between a holding company and an investment company. While they do have a lot of similarities, holding companies and investment companies each have their distinct purposes.

A holding company is a parent business entity that holds the controlling stock or membership interests in its subsidiary companies. The cost to set up a holding company varies depending on the legal entity it is registered with, usually a corporation or an LLC. Large businesses usually set up a holding company because of multiple benefits it brings, including: Protecting assets, reducing risk and tax, no day-to-day management, etc.

An investment company, on the other hand, does not own or directly control any subsidiary companies, but rather is engaged in the business of investing in securities. Setting up an investment company is different from setting up a holding company, as they can mostly be formed as a mutual fund, a closed-ended fund, or a unit investment trusts (UIT). Furthermore, each type of investment company has its own versions, such as stock funds, bond funds, money market funds, index funds, interval funds, and exchange-traded funds (ETFs).

A corporate provider or company provider has skills and knowledge that are necessary for every business entity at some time throughout their operation. A corporate provider makes sure that a company complies with all applicable laws and norms set forth by the local government where the business is located.

All the legal compliance requirements could be difficult for new businesses. The cost of hiring a company provider may also be prohibitive for small businesses because of the temporary nature of the position.

Typically, a corporate service provider has a section for corporate secretarial services with a group of devoted corporate secretaries. In relation to incorporation-related issues, it can also provide legal and tax advising services.

Corporate businesses offer accounting and tax services in addition to assisting new business owners in setting up their operations legally. You can save time and money by working with an expert corporate service provider. Here are 2 main reasons why you need to hire a corporate service provider for your business:

Incorporating a business can be time-consuming. It is a protracted process that needs both time and knowledge. Furthermore, if you complete everything by hand, you risk skipping a step in the registration process. It is generally advisable to contract out this responsibility to a corporate service provider in order to produce the papers flawlessly. A corporate service provider has the knowledge and experience required to register your corporation under legislation.

The governments always work to improve their laws and regulations to keep up with the evolving economy. Even if a business owner can always handle the necessary documentation, it can be challenging to keep up with the constantly evolving regulatory requirements. The professionals in a corporate service keep track of all such changes through the press or courts. A business owner only needs to select a suitable company that offers the needed corporate service providers.

Even though it is one of the shorter parts of a business plan, you should devote the most effort to it.

No matter how many pages your business plan is, whether it is five or thirty, the executive summary section must summarize everything in the plan in only two pages. This section draws a lot of attention because the reader may simply glance at it before deciding whether to continue or stop reading.

Reading the competitive analysis section helps comprehend enterprises’ competition.

About five competitors should be listed here, along with their advantages and disadvantages. When examining your competition, some points to consider include:

Your marketing action plan, which is utilized to put your business idea into practice, develops the precise marketing actions.

Make a note of the implementation costs for each of the five marketing phases (the sum of which will be your marketing budget), if enterprises can accomplish each step on their own or if they require help, and the projected sales (which when added together, become the sales forecast).

Include a one-page biography for each of the important figures in your company.

These biographies should be written in a way that shows you've "been there, done that," and you know how to do it again. You want to show that you possess both the technical know-how and the leadership abilities required for the job. Mention your plans for bringing on more team members to fill any potential experience or skill shortages.

The financial statements are one of the last components in your business plan. The business plan is demonstrated to be practical in the parts of products and services, marketing, operations, and personnel, but it is proven to be profitable in the financial area.

The process of starting a new business and taking on any associated risks with the intention of turning a profit is what we typically refer to as entrepreneurship. However, when conducting business, an entrepreneur or a corporation must face a number of difficulties.

You need to engage a corporate service provider for the majority of company formations and lessen many of the difficulties faced by business owners of all stripes. Typically, these difficulties take the shape of one or more of the following elements:

There will always be updated procedures, new policies, and new laws and regulations. CSP focuses on daily investigation, examination, and analysis of all of this data. These regular activities prepare CSP to be highly specialized in processing all the required paperwork that complies with legal requirements. Do you believe it will be as simple to remember, to create all the necessary documentation, and to put into practice as a corporate service provider?

A smooth firm business operation depends on several various functions, including administrative, human resource, accounting, and many more. Other expenses include those for IT and office supplies, technology subscriptions, and other expenses that, regrettably, do not result in any revenue for the organization. The majority of the crucial positions and tasks in a firm are covered by CSP. Consider hiring one individual to fill each position, such as administrative, human resources, and accounting. Do you believe these costs will be more affordable than engaging a corporate service provider?

No matter what sector a company operates in, it is critical that it devote time to research, analysis, and the development of a revenue-boosting plan. Do you believe you have enough time to grow your company and bring in enough money?

One IBC is launching a limited-time 20% discount on total incorporation fees for selected offshore company structures in Hong Kong, Singapore, and Vietnam.

The User Guide to the Key Features on One IBC’s Client Portal is designed to help clients and partners navigate the platform with ease and confidence. It provides a step-by-step overview of the portal’s essential tools — from company management and document storage to service tracking and billing transparency.

There are four rank levels of ONE IBC membership. Advance through three elite ranks when you meet qualifying criteria. Enjoy elevated rewards and experiences throughout your journey. Explore the benefits for all levels. Earn and redeem credit points for our services.

Earning points

Earn Credit Points on qualifying purchasing of services. You’ll earn credit Points for every eligible U.S. dollar spent.

Using points

Spend credit points directly for your invoice. 200 credit points = 1 USD.

Referral Program

Partnership Program

We cover the market with an ever-growing network of business and professional partners that we actively support in terms of professional support, sales, and marketing.

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.