- Notifications

We will only notify the newest and revelant news to you.

Now is an opportune moment to establish a business in Gibraltar. Are you an entrepreneur seeking a strategic gateway to set up a company in Europe? Gibraltar, nestled at the southern tip of the Iberian Peninsula, presents an enticing proposition for aspiring business owners. Its unique position as a British Overseas Territory offers numerous advantages for those looking to expand their operations or initiate a new venture. From a favorable tax regime to a business-friendly environment, Gibraltar stands out as an optimal location for setting up a company. Let's delve into the key aspects of starting a business in Gibraltar.

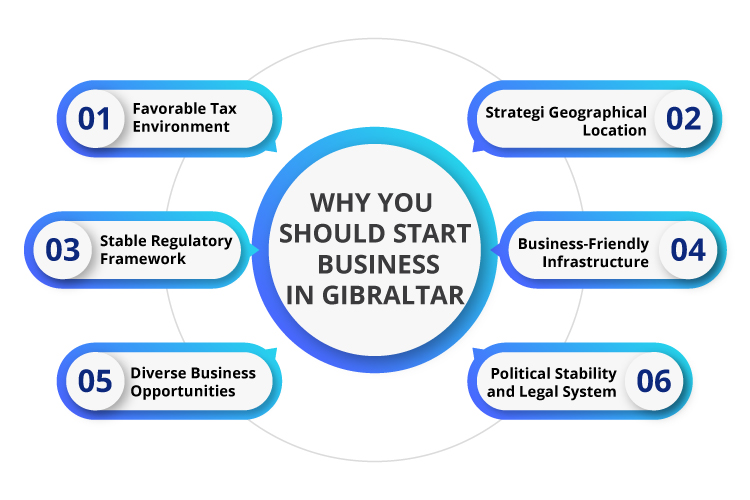

Starting a business in Gibraltar presents a myriad of compelling reasons and advantages that make it an attractive choice for entrepreneurs. Here are 6 main reasons why you should start a company in Gibraltar:

Gibraltar boasts a tax-friendly regime with low corporate tax rates, making it an appealing destination for businesses seeking to optimize their tax liabilities. The territory offers various tax incentives and exemptions, contributing to a more conducive environment for business growth.

Situated at the crossroads between Europe and Africa, Gibraltar's strategic location provides easy access to both markets, making it an ideal gateway for businesses aiming to expand internationally. Its proximity to Spain and the UK further enhances its accessibility.

Gibraltar maintains a robust and stable regulatory framework conducive to business operations. The territory adheres to high standards of regulation and compliance, providing a secure and trustworthy environment for businesses to thrive.

Gibraltar offers a well-developed infrastructure that supports various industries, including finance, gaming, technology, and shipping. From modern office spaces to reliable telecommunications and transportation networks, the territory facilitates smooth business operations.

Gibraltar's economy is dynamic and diverse, presenting numerous business opportunities across various sectors. Whether in financial services, online gaming, tourism, or technology, entrepreneurs can explore a wide range of industries and niches to establish and grow their businesses.

The territory enjoys political stability and a reliable legal system based on English law, providing businesses with a secure operating environment and a transparent legal framework for commercial activities.

Why you should start a business in Gibraltar

Understanding the financial implications of setting up a company in Gibraltar is pivotal for prospective business owners. While the costs may vary based on the type and scale of the business, Gibraltar offers a competitive edge with its reasonable setup expenses. The cost of setting up a company in Gibraltar and ongoing operational fees are often justifiable given the array of benefits and opportunities available in this thriving business hub.

For more detailed information about the cost of setting up a company in Gibraltar, you can connect to famous consulting incorporations like Offshore Company Corp, One IBC, etc. They will have advice on appropriate costs.

Here's an overview of potential cost of setting up a company in Gibraltar:

The initial cost typically includes registration and incorporation fees paid to the Companies House in Gibraltar. These fees depend on the type of company structure chosen, such as a private limited company or a non-resident company.

Engaging legal and professional services is often necessary to navigate the incorporation process smoothly. Hiring a lawyer, accountant, or corporate service provider can incur fees related to drafting legal documents, ensuring compliance with regulations, and obtaining necessary licenses or permits.

A registered office and a registered agent are mandatory requirements for companies in Gibraltar. Renting office space or availing the services of a registered office provider and appointing a registered agent involve recurring costs to maintain legal compliance.

Certain business activities or industries might require specific licenses or permits from Gibraltar's government. Additionally, annual fees for company maintenance, including filing annual returns and keeping the company registered, constitute ongoing expenses.

Beyond the initial setup, operational costs such as rent, utilities, employee salaries, marketing, and administrative expenses should be factored into the overall budget for running the business in Gibraltar.

There might be other incidental costs associated with setting up a business, such as notary fees, bank charges for opening a business account, obtaining a tax identification number (TIN), or any specialized services needed for specific industries.

Gibraltar boasts a plethora of advantages for businesses, making it an attractive destination for entrepreneurs worldwide. One of the standout benefits is its favorable tax regime, with low corporate tax rates and various tax incentives for eligible entities. Additionally, the territory provides a stable political environment, a skilled workforce, efficient regulatory frameworks, and access to the European Union market post-Brexit. Setting up a company in Gibraltar offers a range of benefits for entrepreneurs and businesses. Here are 6 wonderful benefits of setting up a company in Gibraltar:

Gibraltar offers a corporate tax rate of 10% for most companies, except utility firms taxed at 20%. Operating outside Gibraltar exempts a business from corporate tax. There are no capital gains, wealth, sales, value-added taxes, or withholding tax on dividends, making it attractive for foreign investors.

Though lacking double taxation deals, Gibraltar has 27 information exchange agreements. These ensure taxes are solely imposed on income generated within Gibraltar by foreign companies, avoiding double taxation.

Gibraltar's economy is now diverse, focused on finance, gaming, shipping, and tourism. Strong UK ties, English as the primary language, and the pound sterling as currency make it stable. Flexible employment, with half the workforce from Spain, maintains a low unemployment rate of 1%.

Gibraltar's Category 2 status and European Union special status boost credibility for asset protection. It's respected as a financial center, not a tax haven, ensuring reliability.

Incorporating in Gibraltar is quick and automated. Companies comply with UK standards and offer tax benefits. Different structures like Limited Liability Companies require only one director and no minimum capital.

Gibraltar's commitment to high standards in regulation and tax transparency, evidenced by signing Common Reporting Standards (CRS), earns it 'largely compliant' status with OECD guidelines, fostering investor confidence.

For many entrepreneurs, opting for a limited company structure is a preferred choice due to its distinct legal and financial advantages. In Gibraltar, setting up a limited company follows a straightforward process. Entrepreneurs can establish a separate legal entity, limiting personal liability while enjoying the benefits of corporate status, such as credibility and potential tax benefits. Compliance with regulations and fulfilling reporting requirements remains essential for maintaining a Gibraltar-based limited company.

We provide 4 simple steps to set up a limited company in Gibraltar:

Your Gibraltar company details include selecting an appropriate entity type for your business and choosing recommended services for your Gibraltar company:

Payment options include:

A Gibraltar non resident company refers to a corporate entity incorporated in Gibraltar but conducting its business operations and generating income outside the territory. Non-resident companies in Gibraltar benefit from certain tax exemptions, particularly if their profits are derived from activities conducted beyond Gibraltar's borders. These entities are not subject to corporate tax in Gibraltar, making them an attractive option for businesses aiming to operate internationally while leveraging Gibraltar's favorable tax environment.

Gibraltar's non resident company status offers:

Gibraltar non resident company

In conclusion, embarking on a business venture in Gibraltar offers a multitude of advantages, ranging from a favorable tax environment to strategic geographical positioning. The ease of company setup, coupled with the supportive business ecosystem, makes Gibraltar an optimal choice for entrepreneurs seeking growth opportunities in Europe and beyond. Aspiring business owners should explore the nuances of setting up a company in Gibraltar to leverage its myriad benefits and unlock their entrepreneurial potential in this thriving economy.

Latest news & insights from around the world brought to you by One IBC's experts

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.