- Notifications

We will only notify the newest and revelant news to you.

Business access is a pivotal component of the US charge framework, affecting both bosses and representatives. It envelops different sorts of charges that managers are required to deduct and pay on sake of their workers. This direct gives a comprehensive diagram of work charge in the US, counting rates, how to calculate these charges, motivating forces accessible, and the handle for recording returns.

Business charges in the US incorporate government wage charges, Social Security and Medicare charges (too known as FICA charges), and government unemployment assess (FUTA). Bosses withhold wage charge from representative compensation based on profit and the data given in Frame W-4 by the representative. FICA charges are shared between the manager and the representative, each paying half, whereas FUTA is paid exclusively by employers.

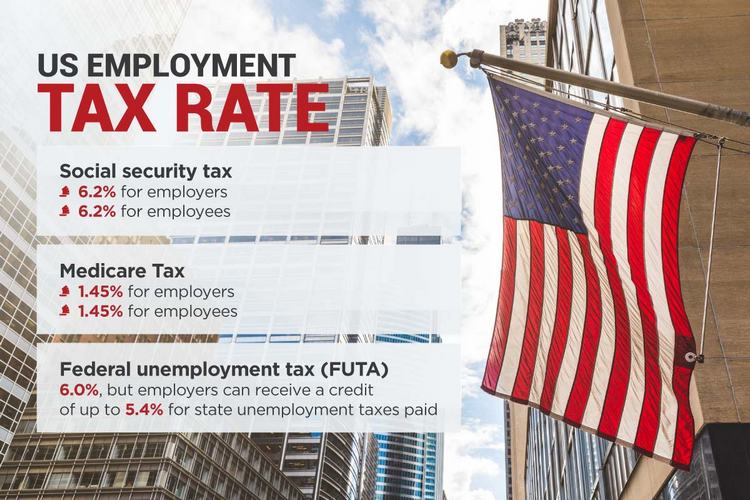

The US employment tax rate includes a few distinctive sorts of charges that bosses must withhold and pay on behalf of their workers. Understanding these rates is basic for compliance and precise finance preparation. Underneath are the fundamental components of business assess rates in the US:

US Employment Tax Rate

Social security charge, authoritatively known as Ancient Age, Survivors, and Incapacity Protections (OASDI), is charged to both managers and workers. The rate for 2023 is:

This access is connected to salary up to the yearly wage constraint, which is $160,200 for 2023.

Medicare charge, which contributes to healing center protections, is another component of FICA taxes:

Unlike the Social Security charge, there is no wage cap for the Medicare charge. Moreover, high-income workers are subject to an Extra Medicare Assess of 0.9% on profit over certain edges ($200,000 for single filers, $250,000 for hitched couples recording jointly).

FUTA charge is paid by managers (not withheld from representatives) and is utilized to support state workforce organizations. The FUTA assess rate is:

6.0%, but bosses can get a credit of up to 5.4% for state unemployment charges paid, which can successfully decrease the FUTA rate to 0.6% on the to begin with $7,000 of each employee's earnings.

The combined rate of work charges that a boss needs to consider incorporates their parcel of Social Security and Medicare charges, furthermore the compelling FUTA charge after state credits. Also, the employee's parcel of Social Security and Medicare charges must be withheld from their wages.

Employment tax calculator can be complex, depending on various factors such as the employee's earnings, tax brackets, and any additional deductions or credits. Many online employment tax calculators are available to simplify this process. These tools require basic information about the employee's salary, filing status, and deductions to estimate the amount of taxes that should be withheld.

The US government offers a few motivating forces to energize work, especially for contracting particular bunches such as veterans, long-term unemployed people, and others confronting noteworthy obstructions to work. These motivations regularly come in the shape of charge credits, which can specifically diminish the sum of assess owed.

In the US, managers are capable of recording work charge returns, which incorporate data approximately the charges they have withheld from their employees' compensation as well as the employer's parcel of these charges. This preparation is significant for compliance with government charge laws. Here’s a direct to the key shapes and recording necessities for employment tax return in the US:

Employment tax return in the US

In conclusion, overseeing business assessment duties is imperative for each boss in the US. Remaining educated approximately assess rates, utilizing calculators for precise withholding, taking advantage of assess motivations, and complying with assess return necessities can offer assistance guarantee that both managers and representatives handle their charge commitments productively and correctly.

Latest news & insights from around the world brought to you by One IBC's experts

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.